This is how we assess ES risks in export transactions

We assess all export guarantee applications to determine the level of environmental and social risks associated with the project. The scope of the risk assessment depends on the value of the transaction, the size of the project, project risks and on the type of the financing. As a rule, the risks associated with the entire project are assessed, even if Finnvera’s export financing is granted only to a small component of the project, or to a delivery of individual equipment.

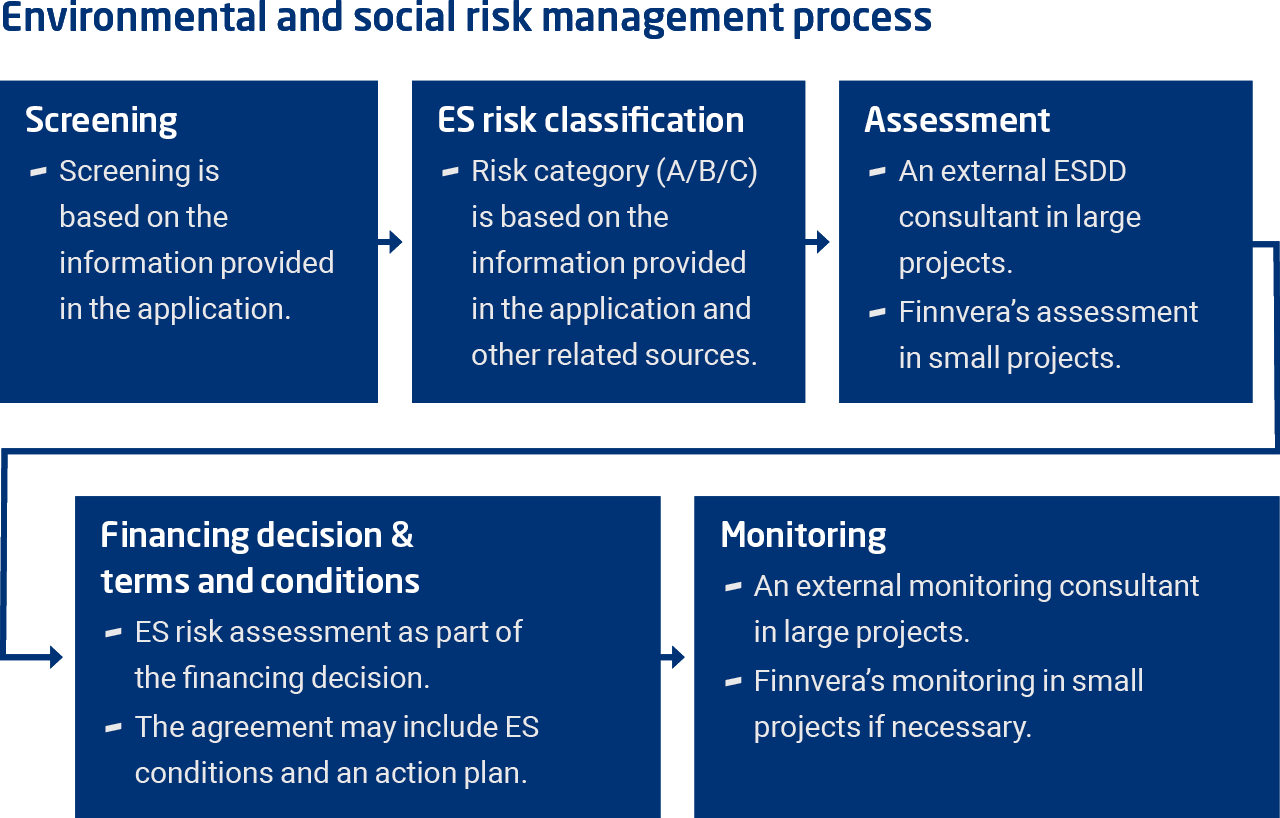

The main steps of the process are:

- Screening

- ES risk classification

- Assessment

- Financing decision and monitoring.

Published projects

In addition, in line with the OECD agreement, Finnvera publishes information on the A and B category projects to which it has committed during the year on the Guaranteed transactions page. The information to be published for Class A projects can be the same as in the pre-publication case, supplemented by more detailed information on export financing.

In addition, Finnvera also strives to publish information on other projects, regardless of the ES risk category. A brief summary of the key environmental and social aspects of the projects may be provided. The publication also covers information on the background material of the assessment and the international standards used. Publications are made with the consent of the parties.

In compliance with OECD agreements, Finnvera releases details about Category A projects, such as project name, location, project description, and information on where to access additional materials (e.g., ESIA report or summary), no later than 30 calendar days before a final commitment to grant official support. Finnvera also conducts Environmental and Social due diligence of the project and welcomes any additional information and comments.