Countries and markets 4/2023: Türkiye strives to stabilise its economy – Finland’s exports to its traditional export partner have even increased in recent years

Türkiye is a major economy with a population of around 83.5 million and a gross domestic product amounting to nearly USD 1,000 billion. Companies in Türkiye have continued their investments, despite challenging economic conditions.

Published date

Türkiye has retained its position among Finnvera’s top 10 countries in terms of its exposure for export credit guarantees, and Finnvera's liabilities for export transactions guaranteed to Türkiye amounted to EUR 0.7 billion at the end of 2022. The most important sectors for export financing include telecommunications, the pulp and paper sector, and the mining and metal sector. Finland’s traditional trade relations with Türkiye are also reflected in exports of consumer goods. Finnish exports to Türkiye have even increased in recent years, despite the weaknesses witnessed in the external value of the lira. Türkiye’s government is seeking to stabilise the country’s economy and curb rising inflation. Despite the issues it has faced, the country’s economy has continued to grow in 2023. In addition, Türkiye’s government has stepped in whenever necessary to support the economy’s growth, for example by increasing bank lending.

Through export credit guarantees and export financing, Finnvera promotes the exporting activities of all Finnish companies not only to Türkiye but everywhere in the world. To date, Finnvera has guaranteed exports to approximately 90 countries. Finnvera also promotes the exporting activities and international aspirations of Finnish SMEs in other ways, such as by organising working capital financing for SMEs that wish to manufacture export products, arranging various guarantees related to the export trade (e.g. advance payment bonds), and providing financing when a company wants to become more established in another country, such as Türkiye.

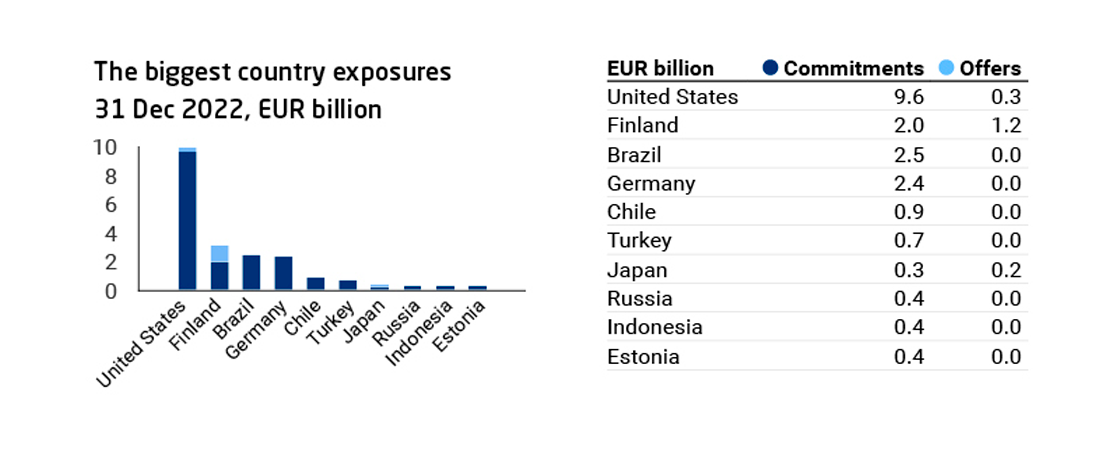

Finnvera's biggest export credit guarantee and special guarantee exposures by country at the end of 2022.

Companies in Türkiye continue to invest, despite challenging conditions – inflation is being curbed with a 40% key interest rate

Türkiye is a major economy with a population of around 83.5 million and a gross domestic product amounting to nearly USD 1,000 billion. Companies in Türkiye have continued their investments, despite challenging economic conditions. Finnvera's export credit guarantees and export financing have allowed companies in Türkiye to finance the purchase of Finnish technology for these investments on competitive terms.

Türkiye’s state, businesses, and banks rely on a great deal of foreign funding, and international financial markets are closely monitoring the country’s policy measures. Following the presidential elections in May 2023, a new economic team was set up to stabilise the economy. One of the most visible measures has been the increase in key interest rates, initiated by the central bank. In May, the key interest rate was pegged at 8.5%, to curb the country’s runaway inflation and allay any fears of further inflation. At its November 2023 interest meeting, the central bank increased the key interest rate to 40% as inflation reached 60%, resulting in negative real interest rates.

| Key figures | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Finnish exports to Türkiye, MEUR | 716 | 691 | 764 | 949 | 1,129 |

| Türkiye’s GDP growth, % p.a. | 3% | 0.8% | 1.9% | 11.4% | 5.5% |

| Türkiye’s inflation, %, end of year | 20.3% | 11.8% | 14.6% | 36.1% | 70% |

| Sources: Exports - customs statistics and GDP and inflation - IMF |

One concern expressed by financers and investors is that the government could abandon its current monetary policy and return to its previous strategy, where it attempted to curb inflation with the opposite approach, namely by lowering the central bank’s key interest rate. The lira has remained susceptible to disturbances, and it has continued to lose its external value this year as well: 1 euro is currently worth over 30 lira.

The country’s economy is expected to grow by more than 4% this year despite various disturbances, such as the devastating earthquake in February 2023. However, the country’s economic growth is expected to slow down by around one percentage point to just over 3% next year, as Türkiye begins winding down its growth-promoting measures. Inflation is expected to slow down significantly in 2024.

Various instruments allow Finnvera to guarantee and finance exports to Türkiye

Country and market data are useful in understanding opportunities and risks, and they also affect the types of financial instruments that can and should be used in various transactions. Türkiye’s country risk classification and country policy are available in Finnvera’s country classification map.

Finnvera will continue to promote financing arrangements related to Finnish exports of consumer and capital goods to Türkiye through export credit guarantees and export financing.

In consumer goods exports, the maximum payment period is typically 6 months. The payment instruments used in export transactions with short payment periods vary from arranged overdrafts to bills of exchange and letters of credit.

Companies in Türkiye are also active in other markets than just their domestic market. Finnish exporters have also traditionally sold their wares to companies in Türkiye for projects carried out in third countries. Finnvera is also able to promote Finnish exports and the financing of export transactions in these projects.

Further information:

Senior Adviser Liisa Tolvanen, the author of this article, works in Finnvera’s country risk management team. She monitors developments in Europe, including Türkiye, as well as in Central and Southeast Asia and Oceania.

Read also:

Finnvera's country classification map

Take a look at Finnvera's guaranteed transactions