Financial Statements of the Finnvera Group for the fourth quarter and 1 January–31 December 2013

Demand focused on the working capital needs of SMEs and on exports

The investments of SMEs remained low in 2013. Financing was mainly needed for working capital and for the rescheduling of existing credits. Demand for export financing was concentrated in a few sectors. Utilising the new export credit system, Finnvera was able to meet export companies’ financing needs.

Business operations and financial trend

Finnvera granted domestic loans and guarantees to SMEs totalling EUR 756 million, which is 11 per cent less than in 2012. The amount of export credit guarantees and special guarantees offered declined by 36 per cent from the previous year, totalling EUR 3,398 million. Direct venture capital investments amounted to EUR 16 million, and they were offered to a total of 85 enterprises.

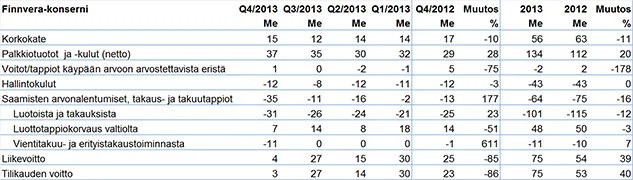

The Finnvera Group’s profit for the year 2013 was EUR 75 million (53 million), or EUR 21 million more than the year before. The main factors contributing to the improved performance were the increase in the parent company Finnvera plc’s fee and commission income in export financing and the decrease in impairment losses on receivables and guarantee losses in SME financing. In contrast, the decrease in the net interest income, caused by lower interest rates and a reduction of the outstanding credits for SME financing, had a negative effect on the profit. The profit of the parent company, Finnvera plc, in 2013 stood at EUR 69 million (56 million).

The Group’s operating profit was EUR 75 million (54 million). The profit was divided between the business areas as follows: The operating profit of SME Financing was EUR 7 million (–4 million) while that of Export Financing was EUR 74 million (62 million). The result for Venture Capital Investments was EUR 5 million in the red (-3 million).

The Finnvera Group’s profit for the last quarter of 2013 came to EUR 3 million. The profit was markedly, or EUR 24 million, smaller than the profit for the third quarter. The factors contributing to the weaker performance during the last quarter included especially the impairment losses on receivables and guarantee losses, which at EUR 35 million were higher than in the previous quarter.

Within the past few years, Finnvera’s outstanding commitments and their risk levels have risen significantly. Risk levels continued to rise in 2013 as well. The rise in risk levels is reflected in SME financing, for instance, as poorer risk ratings for client enterprises and as an increase in the relative share of non-performing receivables and payment delays. Another indication of the higher risk level is that, in recent years, the impairment losses on receivables and guarantee losses materialised in SME financing have been greater than in the past, although in 2013 impairment losses and guarantee losses were smaller than the year before. In export financing, no major losses have been recorded in recent years or in 2013, and no major increases have been made in provisions for losses in proportion to the outstanding commitments.

The group’s key figures on 31 December 2013 (31 December 2012)

- Capital adequacy 17.6% (16.3)

- Cost/income ratio 27.0% (27.6)

- Equity ratio 18.4% (20.3).

Future prospects and impending risks

The unclear economic outlook and a cautious attitude to investments will keep the demand for SME financing low, at least during the first few months of the year. New projects take off slowly, because it is difficult to make decisions on investments and financing concerning risky projects, especially during a recession. Weak signals of recovery are more frequent than before, but any appreciable revival of Finnish exports is still on a shaky foundation. As a result, Finnvera's export financing solutions are important for the competitiveness of Finnish export companies. Demand for export credits and export credit guarantees is maintained by risks in buyers’ countries, the slow economic growth and stiffer competition on export markets, where financing solutions available to the buyer gain added weight.

According to the current estimate, the Finnvera Group’s financial performance for 2014 is likely to fall below that for 2013. The uncertainty factors associated with economic trends make it difficult to predict the financial performance. If the materialisation of risks is more widespread than anticipated, the situation may weaken considerably.

CEO Pauli Heikkilä:

“In Finland, the economic situation was still in the doldrums in 2013. This was affected by a lack of investments as well as Finland’s industrial structure and the weakening of competitiveness, both of which were reflected in Finnish exports. Some signs of revival were visible on the world market, and in their wake some of our client enterprises did remarkably well.

For their part, financial markets have adapted to changes brought about by regulation, and bank financing still functions reasonably well in Finland. On the other hand, banks have altered their strategies, which can be seen, for example, as stricter security and self-financing requirements. The pricing of risks has also been adjusted. The result is that the margins of new bank credits have widened. According to surveys conducted, the smallest SMEs perceive that the availability of financing has declined the most; however, the principal reasons for financing difficulties have been a falling turnover and weak profitability.

Thanks to the measures taken in line with the Government Programme, Finnvera now has better opportunities for financing SMEs and applying enterprise analysis to make realistic assessments of their potential for profitable business. During spring 2014, the Government will probably decide on Finnvera’s authorisation to grant export financing. Ensuring sufficient authorisation would be pivotal for capital goods exporters. In addition, the Government is likely to decide whether Finnvera is given the task of subscribing to bonds issued by SMEs.”

Financial Statements 2013 (PDF)

Statement on the Corporate Governance and Steering System (PDF)

Additional information:

Pauli Heikkilä, Chief Executive Officer, tel. +358 29 460 2400

Ulla Hagman, Senior Vice President, Finances and IT, tel. +358 29 460 2458

DISTRIBUTION

NASDAQ OMX Helsinki Oy

Oslo Børs ASA

The principal media

www.finnvera.fi

Finnvera publishes its Annual Report for 2013 as an electronic document on the company’s website in the week 11. The Annual Report also includes the Corporate Responsibility Report.