Export financing for fossil fuels will be reduced by international agreements – Finnvera restricts export credit guarantees for oil and gas projects

Published date

In the future, Finnvera will not grant export credit guarantees for new oil or gas fields, extensions of old ones or any fixed infrastructure related to them, such as the construction of oil pipelines. The sectoral policy approved by Finnvera's Board of Directors is based on the measures and objectives against climate change laid down in Finnvera's strategy and the international climate objectives to which the state of Finland is committed. In 2021, Finland joined the Export Finance for Future (E3F) coalition and signed the Statement of the Glasgow Climate Conference. These include ending public export finance for fossil fuels by the end of 2022, with certain clearly specified exceptions.

In the future, Finnvera will only grant export credit guarantees for oil-fired power plants that act as reserve power plants or secure isolated networks in remote areas. In respect of gas-fired power plants, export credit guarantees can be granted for plants that produce balancing power for renewable energy or that replace production with higher emissions.

“The sectoral policy will bring concrete goals to Finnvera's strategy, the key elements of which are to help companies benefit from the opportunities provided by climate action, to measure climate impacts and to identify the risks of climate change. The policy continues the decision made a year ago when Finnvera detached itself from the financing of coal-fired power plants or related infrastructure in accordance with the OECD guidelines. As an export credit agency, we finance new investments that typically replace old, more polluting technologies. Finnish companies have been active in seeking these new climate solutions,” says Jussi Haarasilta, Executive Vice President, Large Corporates.

The policy does not cover, for example, short-term export transactions, which often concern smaller partial deliveries, and sectors outside energy production, such as vessels, power production in energy-intensive sectors and power production for critical infrastructure of society.

The policy will apply to new export credit guarantee applications from the beginning of 2023. Finnvera's financing will still remain suited for most sectors.

Finnvera's own and E3F reporting increase transparency in the financing of energy projects

In its annual reporting for 2021, Finnvera examined for the first time the company's exposure related to energy production and its distribution between renewables and fossil fuels. The exposure of export financing related to energy production and distribution amounted to EUR 758 million at the end of 2021. Of the total, 66% was related to fossil energy, 24% to renewables and 6% to peat. The remaining 4% were unclassified.

The E3F statement also requires greater transparency on policy and supported projects. Finnvera joined the report on energy related transactions implemented by export credit agencies published by the E3F countries in June 2022. The report covers the years 2015–2020 and is based on export projects reported in accordance with the OECD project classification. This makes it possible to compare different countries. The objective is to provide uniform annual reports on how much officially supported export financing is allocated to fossil energy projects and how much to renewable energy projects.

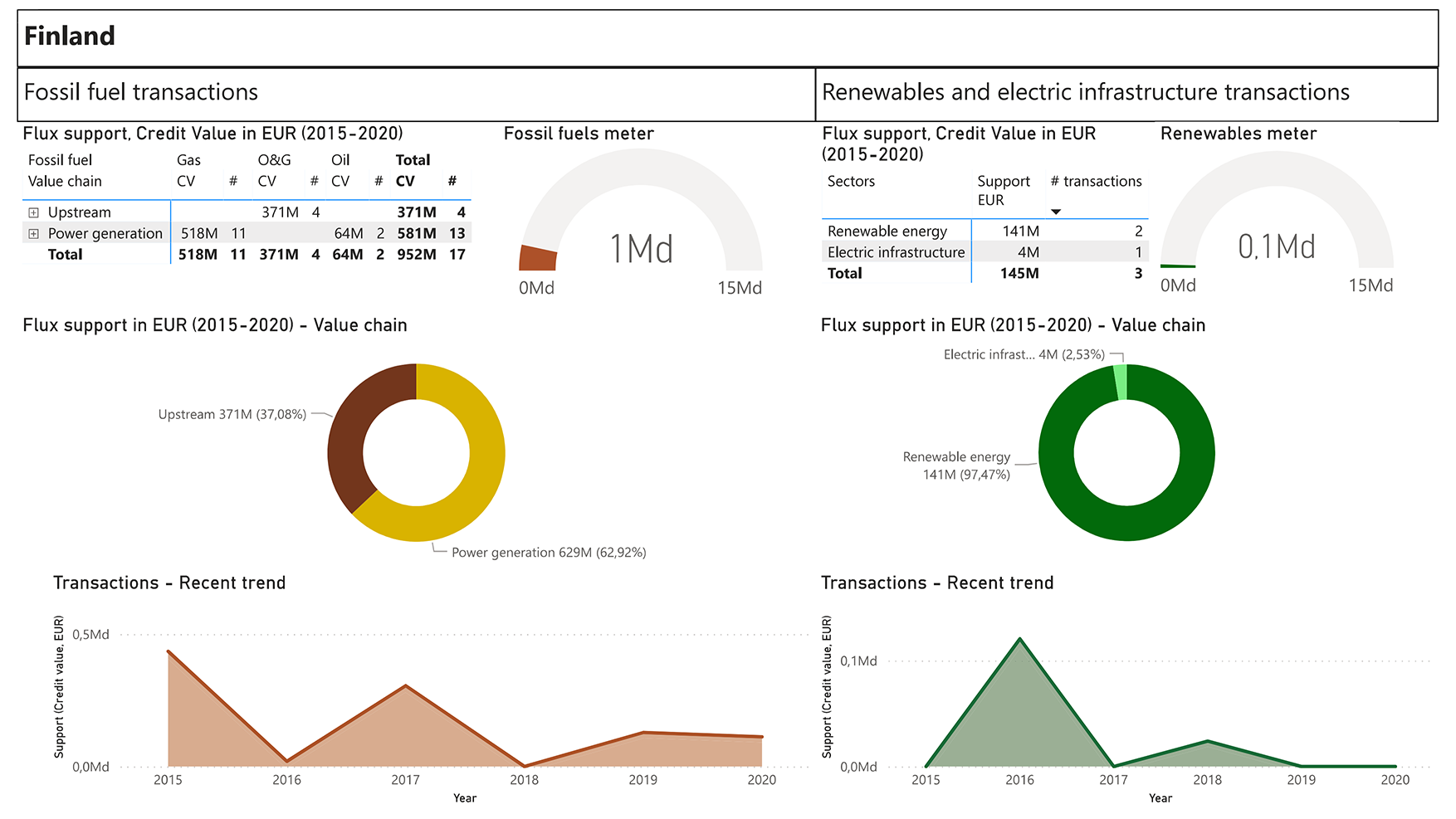

The excerpt from the E3F countries' report from 2022 shows how much Finland has financed exports to fossil energy-related projects and how much to renewable energy projects in 2015-2020. The reporting is based on export projects reported in accordance with the OECD project classification.

“The figures from different countries reflect the structure of each country's export industry – export credit guarantee activities are always based on demand for financing. When assessing Finnvera’s future development, we can assume technological development to increase the number of renewable energy projects. Until now, Finnvera has been involved in guaranteeing relatively few oil and gas projects, which means that individual projects stand out in the statistics,” says Pekka Karkovirta, Vice President for International Relations at Finnvera.

Further information:

Jussi Haarasilta, Executive Vice President, Large Corporates, Finnvera, tel. +358 29 460 2601

Pekka Karkovirta, Vice President, International Relations, Finnvera, tel. +358 29 460 2768

E3F

The Export Finance for Future (E3F) coalition was established in April 2021 to promote and support the transition of investments towards climate-neutral export projects and greater transparency on climate impacts. The other members of the E3F in addition to Finland are the Netherlands, Belgium, Spain, Italy, France, Sweden, Germany, Denmark and the United Kingdom.

The E3F report on energy related transactions implemented by export credit agencies

More on the topic:

Sectors Finnvera can not finance