Key information about Finnvera's financing

By providing financing, Finnvera influences the competitiveness of Finnish enterprises - their opportunities to operate and grow in Finland and to enter international markets. Finnvera can provide financing for most sectors.

Finnvera enables comprehensive financing solutions that encompass the Finnvera Group's own products and the services offered by other public and private financiers.

Financing and outstanding commitments

| Offered financing (EUR bn) | 2025 | 2024 | 2023 | 2022 | 2021 |

| Domestic loans and guarantees | 1.0 | 0.9 | 1.8 | 1.0 | 1.5 |

| Export credit guarantees, export guarantees and special guarantees | 7.0 | 2.9 | 5.4 | 5.9 | 4.6 |

| Total | 7.9 | 3.8 | 7.2 | 6.9 | 6.1 |

| Outstanding commitments (EUR bn)* | 12/2025 | 12/2024 | 12/2023 | 12/2022 | 12/2021 |

| Domestic loans and guarantees | 2.1 | 2.9 | 3.0 | 2.7 | 3.0 |

| Export credit guarantees, export guarantees and special guarantees | 23.1 | 21.1 | 23.4 | 23.4 | 22.7 |

| Total | 25.2 | 24.0 | 26.4 | 26.2 | 25.7 |

| *The exposure includes binding credit commitments as well as recovery and guarantee receivables. | |||||

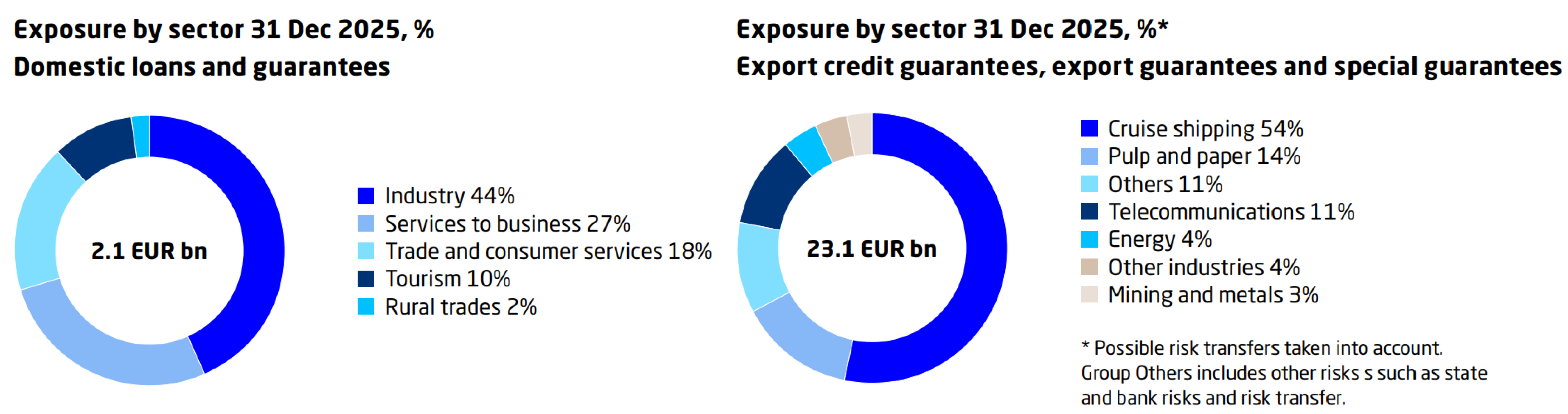

Exposure by sector

Finnvera financing is suitable for most sectors and industries. However, there are certain sectors that are not covered by Finnvera's financial operations.

Risk-taking

Controlled risk-taking is an integral part of Finnvera’s operations. According to the goal of self-sustainability set for Finnvera’s operations, income received from commercial operations must, in the long-run, cover both the company’s own operating expenses and the credit and guarantee losses for which it bears responsibility.

Turnaround

The monitoring of client companies’ financial and operational situation is part of Finnvera’s risk management. Finnvera’s aim is to respond to any weakening in the client enterprise’s situation as early as possible in order to secure viable business.