PDF publications

Key figures

Financing granted

LOANS AND GUARANTEES GRANTED

1.0 bn EUR

(0.9)

EXPORT CREDIT GUARANTEES, EXPORT GUARANTEES AND SPECIAL GUARANTEES GRANTED

7.0 bn EUR

(2.9)

EXPORT CREDITS (EUR 3.1 bn OF WHICH FELL THROUGH DURING THE YEAR)

5.6 bn EUR

(0.6)

Clients in 2025

NUMBER OF CLIENTS AT YEAR END

19,300

(21,100)

THE SHARE OF GUARANTEES OF THE DOMESTIC FINANCING

81%

CLIENTS WILLINGNESS TO RECOMMEND FINNVERA (NPS)

78 points

(78)

Finnvera Group

RESULT

16 MEUR

(228)

RESULT BEFORE THE RETURN OF FUND PAYMENT COMMITMENT

365 MEUR

(228)

BALANCE SHEET TOTAL

15.5 bn EUR

(14.8)

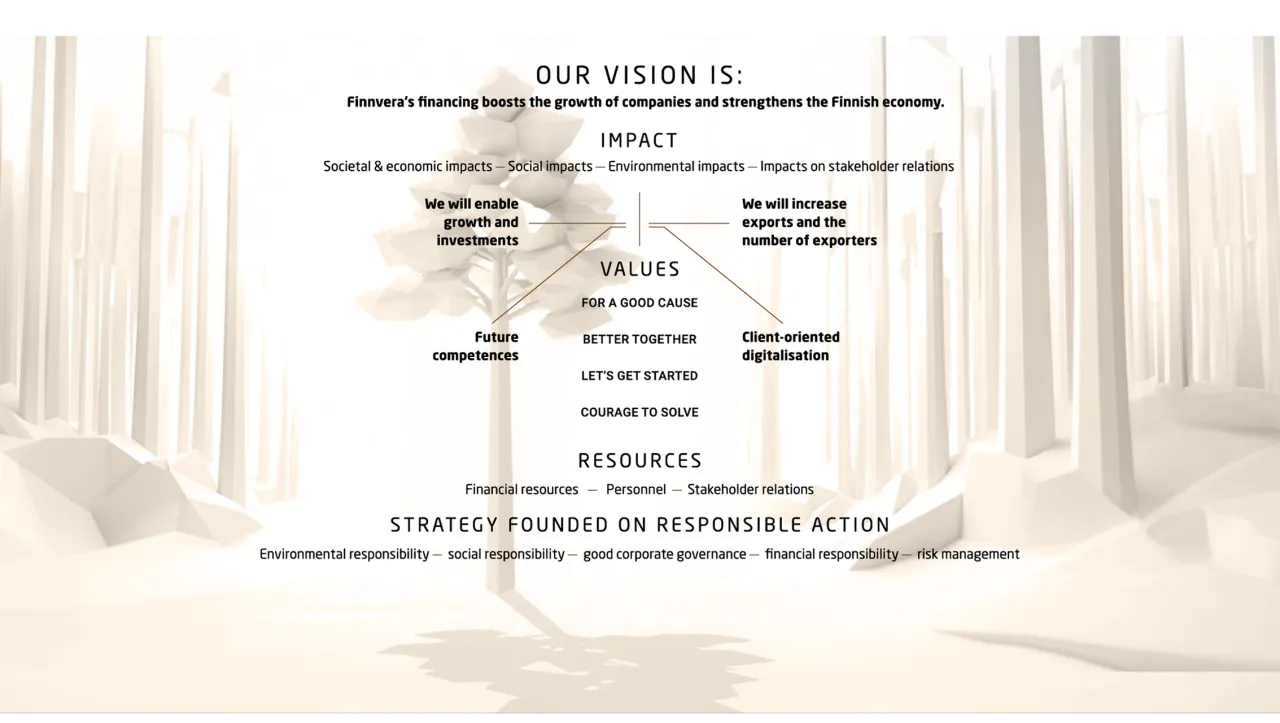

This is how Finnvera creates value