The Finnvera Group’s Interim Report for January–September 2014

More tools and authorisations for enterprise financing

Thanks to legislative amendments and Government decisions, Finnvera has gained important additional authorisations to participate in the financing of projects undertaken by both SMEs and export companies.

Finnvera can increase risk-taking in the financing of SMEs because the compensation paid by the State of Finland to Finnvera will cover a greater share of potential losses in Southern Finland as well. In export financing, the statutory ceilings for export credit guarantees and export credits have been raised markedly. The new financing instruments include the option to subscribe to bonds issued by SMEs, the joint Team Finland LetsGrow financing programme of Finnvera, Finpro and Tekes, and the possibility to guarantee domestic investments associated with exports.

Russia’s weakened economy and the sanctions and retaliatory sanctions that have stemmed from the Russo-Ukrainian crisis have strained Finnish companies engaged in trade with Russia. The sluggish economy and the low investment level were reflected in the demand for financing.

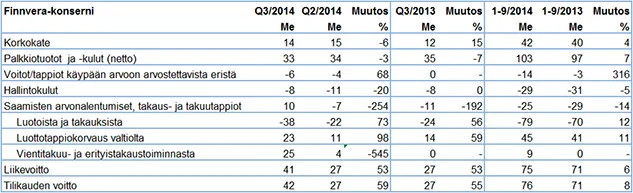

Business operations and the financial trend

The euro sum of the loan and guarantee offers given to SMEs in January–September was slightly higher than during the corresponding period the year before. Many of the offers continued to be associated with working capital or with the rearrangement of financing granted earlier. The amount of offers given for the financing of export trade was almost one third higher than at the same time the year before.

The Finnvera Group’s profit for January–September was EUR 76 million. This was 8 per cent more than for the first nine months of 2013 (71 million). The main factors affecting the improved performance were lower administrative expenses than last year, the increase in net interest income and fee and commission income, and decreased guarantee losses and loss provisions in export credit guarantee and special guarantee operations. Underlying the increase of the fee and commission income were some individual major export credit guarantees that came into effect and the general rise in risk premiums on the market. In contrast, the improved performance was weighed down by impairment losses on receivables in SME financing and by losses from venture capital investments, both of which were greater than the year before.

The financial performance of export financing and SME financing by the parent company, Finnvera plc, came to EUR 85 million, or EUR 11 million more than during the corresponding period the year before (74 million). Finnvera plc’s profit for export financing was EUR 79 million (63 million) and that for credits and guarantees in SME financing EUR 4 million (11 million).

The Group’s key figures on 30 September 2014

- Equity ratio 15.9 per cent (19.3 per cent/30 September 2013)

- Capital adequacy, Tier 2 18.2 per cent (16.9 per cent/30 September 2013)

- Cost-income ratio 25.3 per cent (25.1 per cent/30 September 2013)

Outlook for financing

The economy has started to revive in the United States, but in Europe growth continues to be sluggish. Political turmoil in the Middle East maintains the overall uncertainty. Owing to the dispute between Russia and Ukraine, uncertainty about the financing of transactions to Russia, a market important to Finnish exporters, will continue.

Banks are very cautious when funding transactions in Russia, as banks operating in the EU must also consider the existing and anticipated sanctions posed by the United States. In Finland, SMEs and medium-sized enterprises encounter increasing difficulties in financing export trade, as banks are directing their export finance services to projects that are more profitable to banks, which in practice means major companies and their larger transactions.

The decision on the ownership of the Turku shipyard, reached in September, and the new orders publicised at the same time, mean that Finnvera’s commitments pertaining to shipbuilding contracts will rise. The authorisation to guarantee debt financing for domestic investments associated with exports, which came into effect at the beginning of September, has aroused much interest among export companies and Finnvera’s financing partners. It seems that this opportunity given to Finnvera to share risks can be a significant boost to decisions concerning new investments, and investments to replace ageing production capacity, within the export industry. The reform may also promote individual infrastructure investments serving the export industry, as well as domestic deliveries of equipment and services for these projects.

Finnvera does not expect the demand for SME financing to reach a very high level during the final months of the current year. The factors contributing to this situation include the pessimistic economic outlook, an unusually low investment level and, in part, the regulations posed on banks. Increasingly often, SMEs need financing for working capital.

According to the current estimate, the Finnvera Group’s financial performance for 2014 is likely to reach at least the same level as in 2013. A similar estimate made early in 2014 expected the financial performance to fall below that in 2013. The uncertainty factors associated with economic trends and if more risks materialise than has been anticipated, the situation may weaken considerably from what is projected.

CEO Pauli Heikkilä:

“During the past couple of years, and especially this year, the government has greatly improved Finnvera’s possibilities to provide public financing. Thanks to the amendments made to legislation and commitments, we can increase our risk-taking in both SME financing and export financing. The possibility to subscribe bonds issued by SMEs and to guarantee large enterprises’ domestic investments relating to exports diversified our selection of instruments. It would be essential, as of the beginning of next year, to implement the financing possibility for enterprises larger than the SME definition applied by the EU so that measures such as the possibility to subscribe bonds could be utilised in our enterprise financing. I also hope that the legislative proposal for what are known as refinancing guarantees will be presented before the end of the year. After these changes we can state that, in terms of authorisations and financial instruments, we are on the same level as our principal competitor countries.

The consequences of recent events complicate the operations of Finnish companies engaged in exports to Russia.

For this reason, the turnover of an SME may have fallen considerably. We can offer financing to strengthen the working capital of SMEs that are encountering difficulties because of the crisis. We also continue to grant export credit guarantees for exports to the Russian market. We comply with the sanctions approved in the EU and we assess our possibilities to participate in projects on a case-by-case basis, in keeping with our normal criteria.

Finnvera also continues to provide venture capital investments for innovative start-up enterprises. Owing to the decisions made on the division of tasks between public actors, we shall gradually give up venture capital investments within the next few years.”

Interim Report 1 January–30 September 2014 (PDF)

Additional information:

Pauli Heikkilä, CEO, tel. +358 29 460 2400

Ulla Hagman, Senior Vice President, Finances and IT, tel. +358 29 460 2458