Finnvera invests in managing environmental and social risks

On our export credit guarantee applications, companies are asked about how and where the export product will be used, as well as about its potential environmental and social impacts and risks. The purpose is to find out about the ecological values of the project site and determine if the investment could have impacts on the people living in the area, especially any vulnerable groups.

Published date

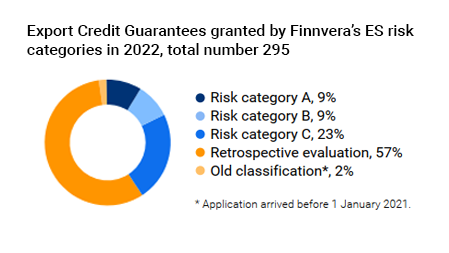

Finnvera screens all export financing applications for environmental and social risks. A total of 371 export credit guarantee applications were received in 2022, one third of which were scrutinised by the environmental and social risk management team after screening. Careful project assessment is part of Finnvera's risk management and financing process from the application stage on.

Updated process for managing environmental and social risks now in regular use

Finnvera identifies projects which may have major environmental and social impacts and high risks based on export credit guarantee applications and other potential information sources. The themes of the risk assessment include the reputation of the export product’s end user, human rights and political situation in the country, environmental and social risks inherent in the combination of the country and sector, and environmental factors of the site, including the proximity of nature conservation areas and the status of indigenous peoples.

Indicators have been defined for different thematic areas, on the basis of which the application is assigned a risk cate- gory (A/B/C) as defined by Finnvera. An application related to an investment that may involve significant, permanent and extensive negative environmental and social impacts, including human rights risks, is placed in risk category A. In risk category B, the impacts are smaller and easier to manage, local and largely reversible. Even in risk category B, projects involving a higher risk are assessed more thoroughly. Applications in risk category C are not associated with negative environmental and social impacts, or these impacts are minor. Consequently, no environmental and social assessment is needed for an application placed in risk category C.

Of the 295 guarantees granted in 2022, 98% were handled in accordance to the new process.

The risk classification is based on internationally recognised and reliable sources of objective information on such issues as the target state's human rights situation. If the risks associated with the sector are high and the target country’s legislation related to environmental and social risks is weak or its enforcement is lacking, Finnvera has a more stringent obligation to ensure that national and international requirements are met.

Finnvera’s possibilities of influencing the environmental and social factors of the project also play a role in risk management and the financing decision. The UN Guiding Principles on Business and Human Rights (UNGP) are taken into account when assessing financing projects. Finnvera participated in a central government actors’ development project that sought practices for incorporating human rights considerations in the work of Finnish providers of financing in the public sector. The final report of this project led by the international expert organisation Shift was published in December 2022.

Screening of applications in 2022

Finnvera received a total of 371 (455) export credit guarantee applications in 2022, of which 47% concerned short-term documentary credits and bank risk guarantees, for which a retrospective assessment of environmental and social risks is carried out annually. 15% of the applications concerned guarantees for consumer products and raw materials in transactions where no significant risks associated with either of the parties were found. These guarantees were directly placed in the low risk category C. The remaining 118 applications (32%) mainly concerning capital goods were assessed by Finnvera's team of environmental and social risk advisers. 36% of them were initially placed in risk category A, 29% in risk category B, and 19% in risk category C. Of the 295 guarantees granted in 2022, 98% were handled in accordance to the new process.

Large high-risk projects for which an extensive risk assessment must be conducted accounted for 9 (2%) of the export credit guarantee applications received in 2022. Requirements aimed at reducing and preventing negative environmental and social impacts and risks are included in financing agreements of large projects. A project monitoring plan is also agreed upon as part of the financing agreement. In projects whose risks were assessed to be particularly high, an independent consultant monitors the activities throughout the loan repayment period.

When conducting its assessments, Finnvera works closely together with various stakeholders, including other export credit agencies, export companies, buyers, and banks. The prerequisites for going ahead with the project are discussed with the parties to an export transaction. The aim is to be proactive and provide guidance, enabling the transaction to meet the financing decision requirements. No financing applications were rejected by Finnvera due to environmental and social risks in 2022.

In large category A projects, which include pulp mills, mines or power plants, the processing time of applications is typically months or even years. The largest projects assessed in 2022 were located in Brazil.

Site visits resumed

In major projects, an independent consultant visits the site to be financed and prepares an Environmental and Social Due Diligence (ESDD) report. The report assesses if the project meets the requirements of the World Bank Group’s Environmental, Health, and Safety Guidelines and the IFC Environmental and Social Performance Standards as well as other possible preconditions set by Finnvera. In addition, it sets out the measures that must be taken to meet these requirements. In some cases, a Finnvera expert pays a visit to the site.

While site visits could not be organised for two years during the coronavirus pandemic, they were resumed in 2022. A Finnvera ES adviser visited two sites to be financed. On such visits, the adviser assesses the operator's attitude, ability and practices related to risk management. The adviser also listens to the opinions of various stakeholders in the area affected by the project, including NGOs, authorities and people, to get a comprehensive overview of the project and to understand local circumstances.

Finnvera integrated measures to prevent money laundering and terrorist financing into its operational risk management policy

Finnvera's operating policies are reviewed and updated annually. In 2022, Finnvera’s measures to prevent money laundering and terrorist financing were integrated into a new policy for managing operational risks.

In particular, the policy measures cover the Know Your Customer (KYC) principles and basic premises of compliance with sanctions in finance.

The KYC process based on money laundering regulation is an essential part of processing financing appli-cations at Finnvera. It includes registering the clients’ identifying data and information on the company’s ownership structure, the nature of its business and the object of financing. Finnvera also requires applicants to provide information in their applications on who the actual beneficiaries are and whether a beneficiary in the customer company is a politically exposed person. The background screening also extends to the export company's buyer customer and, if necessary, to other parties in the project to be financed in most export financing products.

The goal in 2023 will be overall development of environmental and social risk monitoring and reporting in projects financed by Finnvera.