Export payment methods

Choosing a payment method is, first and foremost, part of risk management

It is a good idea to compare different payment methods well before making your offer and choose the most suitable option for each case.

Comparing payment methods

The more secure the payment method, the higher the costs involved. Nevertheless, the costs resulting from the payment method are often only a fraction of the impact that a delayed payment or, in the worst case, credit loss would have on your company’s result.

The bank’s role

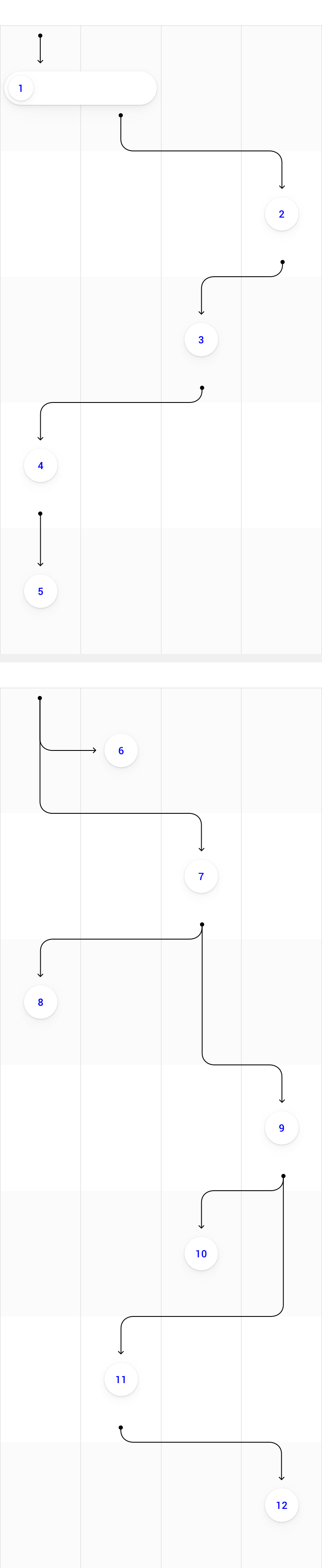

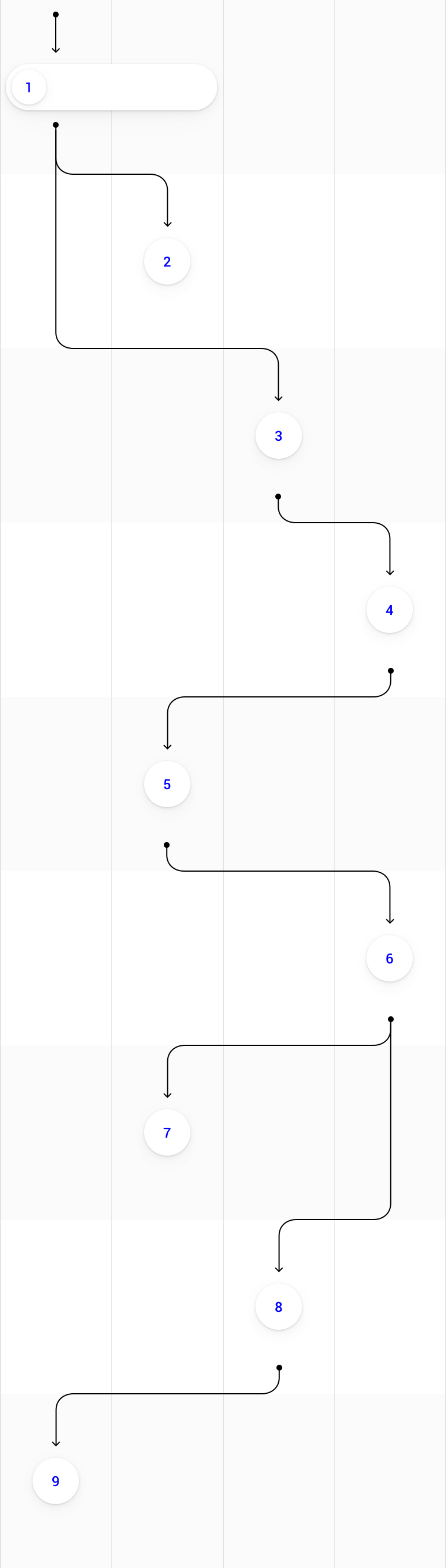

Payment methods are divided into direct payments, or payment orders and cheques, and documentary payments, or foreign collection items and documentary credit.

In direct payments, the bank acts only as the transmitter of payments. In documentary payments, the banks transmit not only payments but also delivery-related documents and supervise the fulfilment of agreed terms and conditions.

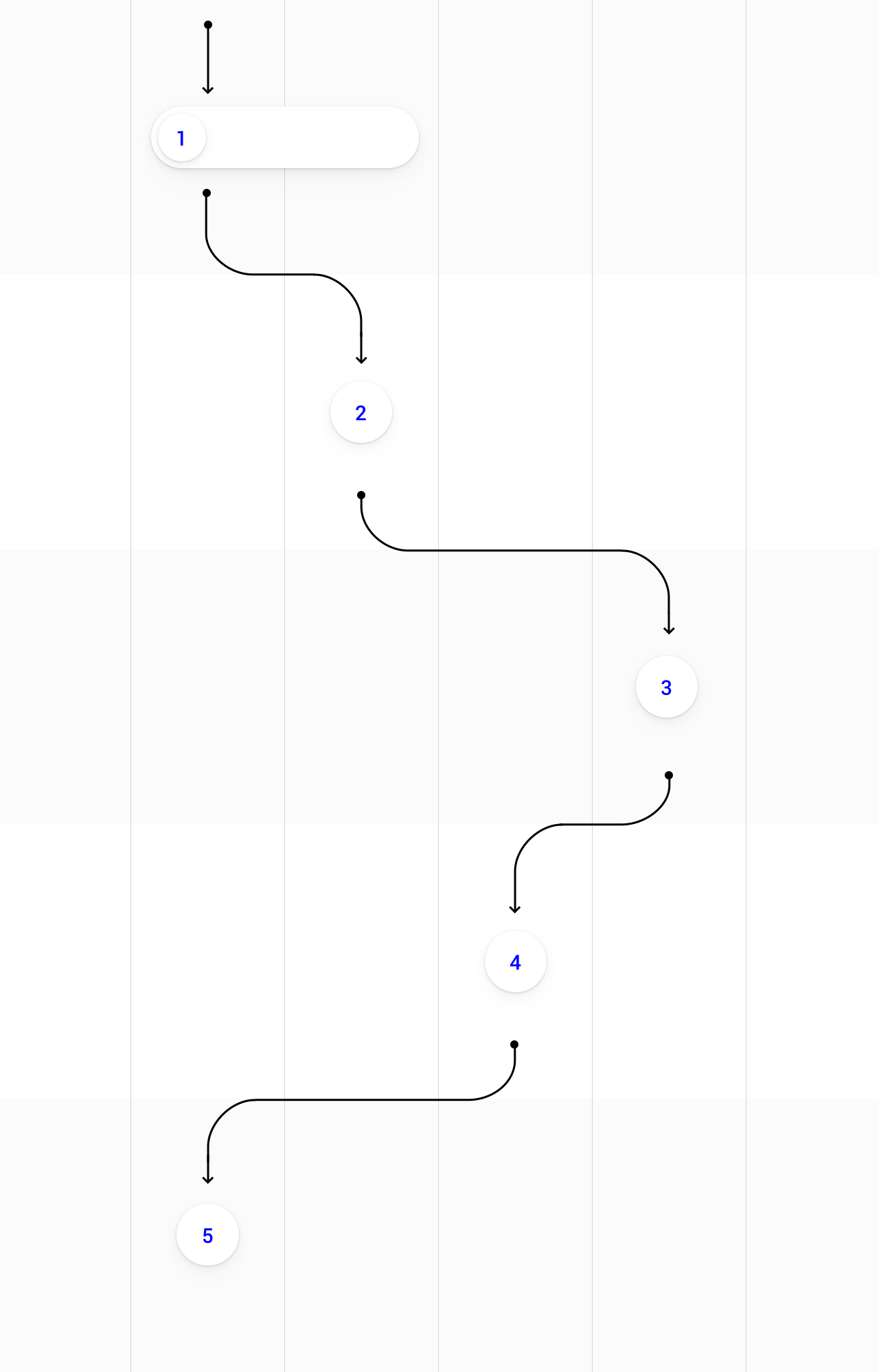

- the company’s risk policy

- counterparty risks (enterprise, country and bank risks)

- competition and market conditions as well as trade practices

- the size and object of the transaction

- the need to offer financing and/or grant time for payment

- speed and costs.

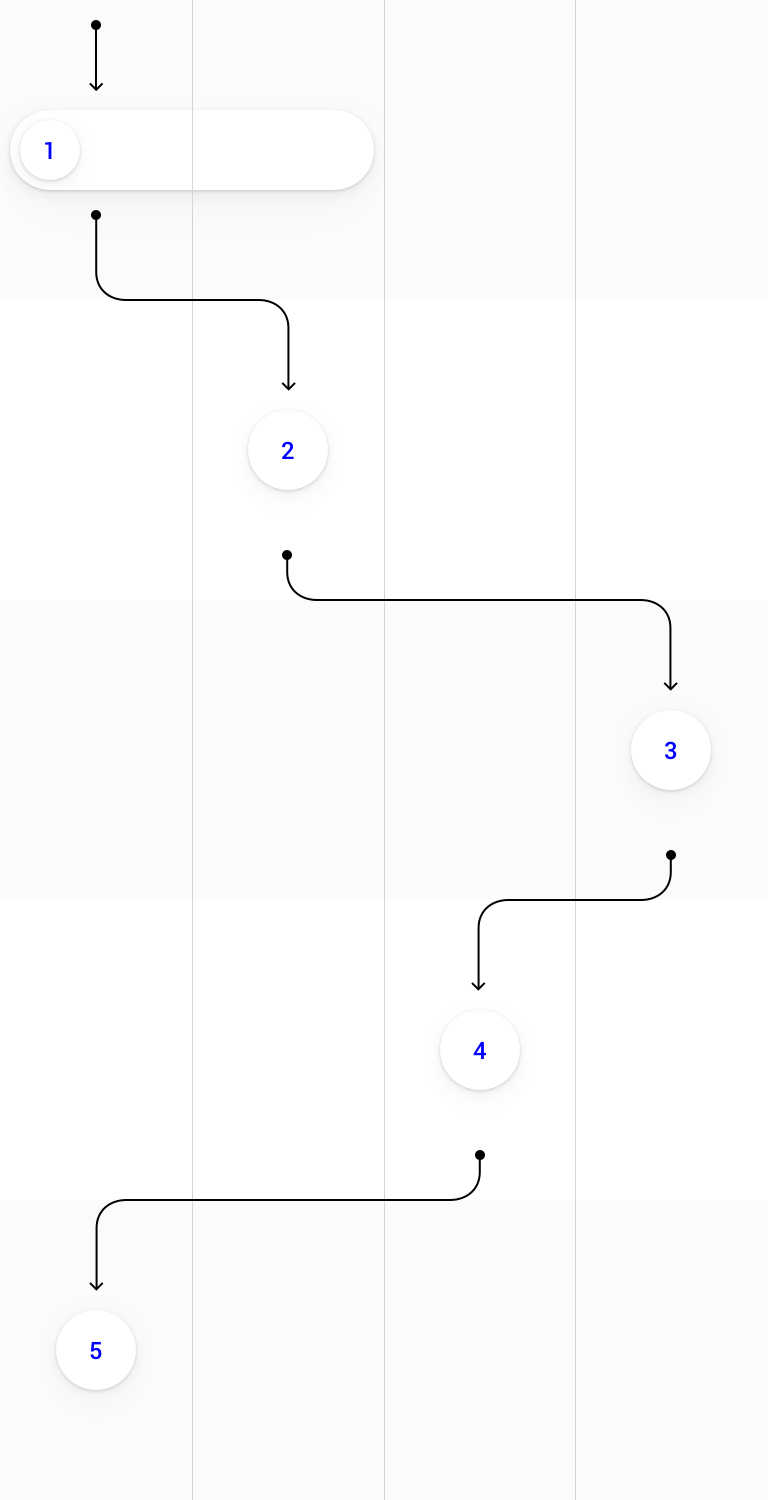

Payment order

The payment order is the equivalent of the domestic bank transfer. It is based on the trust between the buyer and the exporter and it does not protect the exporter from risks related to receiving the payment. The payment order is fast and has lower costs than other payment methods. Depending on the target country, the payment will be on the recipient’s account in 1–3 banking days from being charged from the payer’s account.

Cheque

It is not recommended to use cheques in foreign trade as they are a slow payment method and easy to forge. In addition, it is more expensive to use cheques than payment orders.

Foreign collection item

In connection with foreign collection items, the bank sends commercial documents to the buyer’s bank, which monitors that the payment is made. However, the buyer’s bank does not commit to paying the transaction amount in case the buyer does not make the payment or accept the bill of exchange. Consequently, the exporter carries the risk associated with the buyer’s ability and willingness to pay. The buyer gets the documents into their possession only against payment (documents against payment, D/P) or, if the exporter grants a payment period, after accepting the bill of exchange (documents against acceptance, D/A).

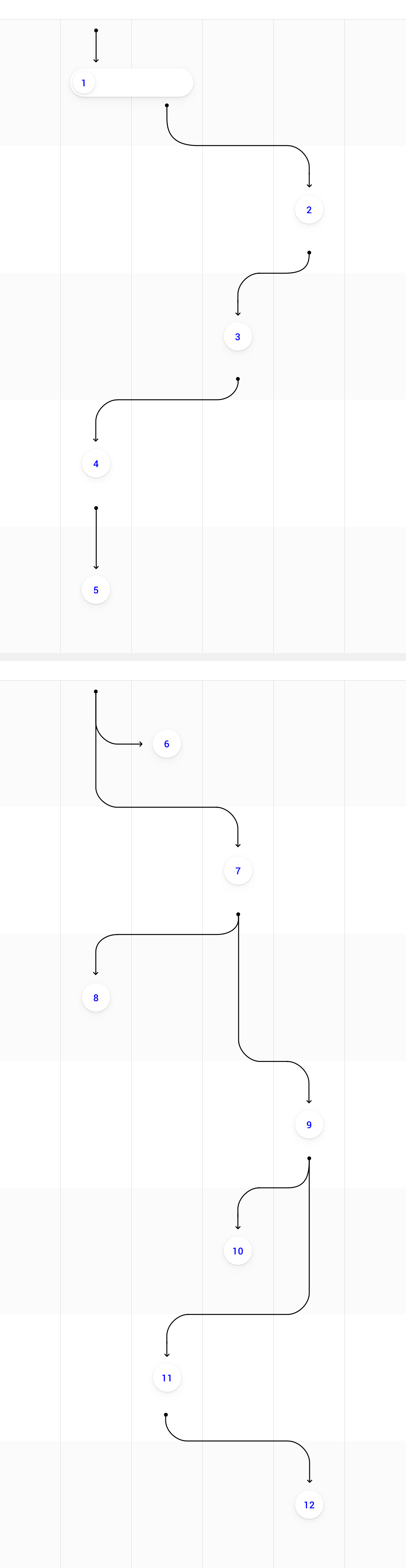

Documentary credit

A documentary credit is the buyer’s bank’s irreversible commitment to pay to the exporter, provided that the exporter fulfils the documentary credit terms and conditions that are based on the sales contract. Using a confirmed documentary credit protects the exporter also from risks associated with the buyer’s bank and country. In the confirmation, the exporter’s bank commits to paying the sum of the documentary credit when the exporter fulfils the documentary credit terms and conditions. When used appropriately, a documentary credit is a 100% guarantee of receiving the payment

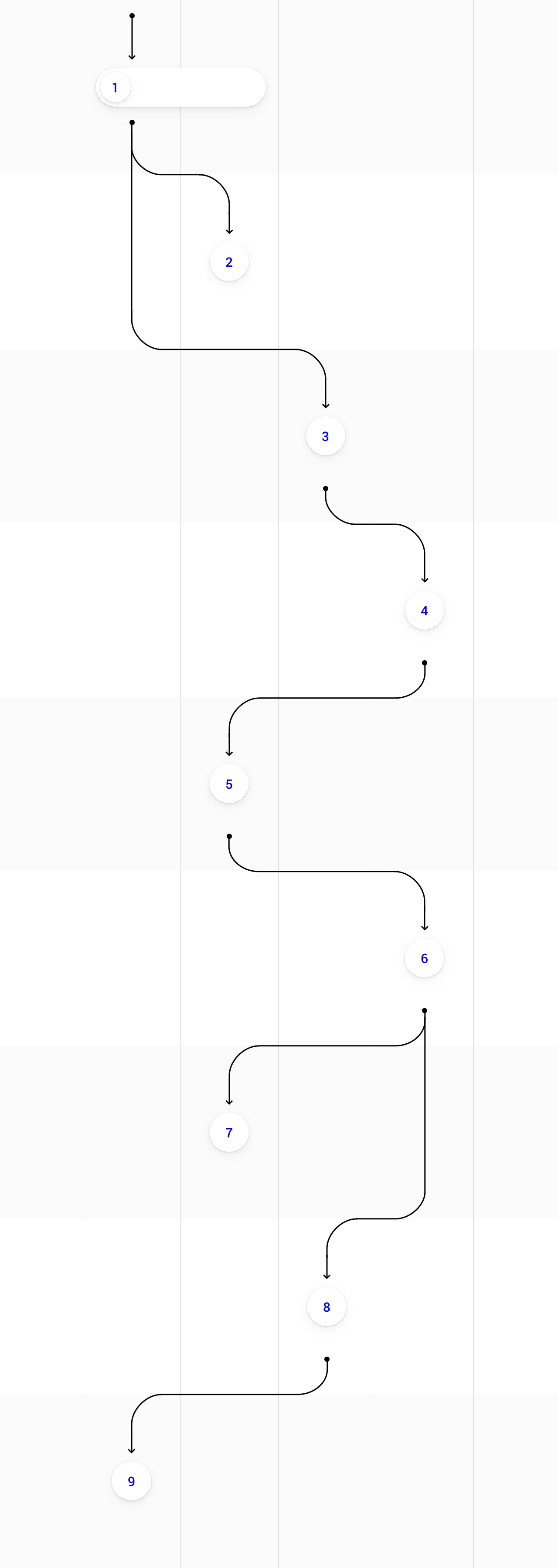

Issuing the documentary credit

Issuing the documentary credit