The Finnvera Group’s Interim Report for January-March 2014

Recovery in the demand for financing hampered by political crises

During the first quarter of 2014, the Finnish financial markets performed better than statements presented in public would suggest. There are occasional blind spots but private providers of funding are well able to meet the demand for financing for credible growth investments, partly with help from Finnvera. However, companies that have several loss-making years behind them and not enough equity are facing major problems.

The crisis between Ukraine and Russia has a negative impact on the economies of both countries. At the end of the period under review, Russia accounted for Finnvera’s third biggest country exposure (EUR 879 million). With the weakening of the Russian economy and a decline in Finnish exports, there has also been a slight decrease in Finnvera’s exposure involving Russia recently. Finnvera continues to provide Finnish exporters with financing for trade with Russia. However, developments are being monitored closely and Finnvera is also prepared for higher risks. Finnvera’s exposure involving Ukraine totalled four million euros and at the moment no new guarantees can be provided for export transactions to that country.

Business operations and financial trend

The euro value of the loan and guarantee offers given to SMEs in JanuaryMarch increased by 15 per cent from the same period in 2013. As in 2013, most of them were associated with the need for working capital. Some of the credit agreement negotiations connected with export transactions that were still uncompleted last year were concluded and as a result, the number of export financing offers increased by 81 per cent from the first quarter of 2013.

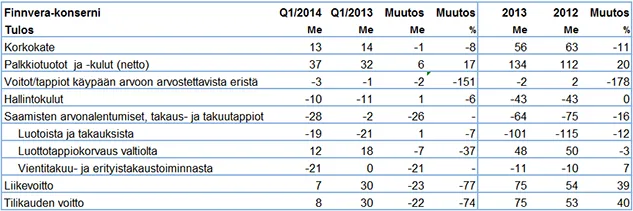

The Finnvera Group’s profit for JanuaryMarch was EUR 8 million. This was EUR 22 million less than the profit for the corresponding period in the previous year (30 million). The most important factors pushing the profits downwards were the increase in the impairment losses on receivables and guarantee losses incurred by the parent company Finnvera plc as well as a decline in net interest income. At the same time, the weakening in profits was partially offset by higher fee and commission income and lower administrative expenses.

The profit from the parent company Finnvera plc’s export financing and SME financing amounted to EUR 10 million, or EUR 21 million less than a year earlier (31 million). Export financing, or the separate result of export credit guarantee and special guarantee operations laid down in section 4 of the Act on the State Guarantee Fund, showed a profit of EUR 5 million (21 million), while the profit for SME credit and guarantee operations amounted to EUR 5 million (11 million).

The Group’s key figures on 31 March 2014 (31 March 2013)

- Equity ratio 18.8% (20.1%)

- Capital adequacy 17.9% (16.0%)

- Expense-income ratio 25.1% (28.3%)

Outlook for financing

During the early part of the year, demand for SME financing will remain at a moderate level, a result of uncertain economic prospects and the low level of investments. Most of the financing needs are associated with working capital and the rescheduling of existing credits.

Finnish exports have continued to decline during the early months of the year and there are no clear signs of any upturn. As a result of the crisis in Ukraine, there is also an exceptional degree of uncertainty in the economic situation. Economic growth in Russia had already slowed down before the crisis and as a result of the crisis, the prospects seem to be getting even weaker. The state of Russia’s banking and financing system and the economic sanctions will also make it more difficult for companies to get financing in Russia, which will have a direct impact on Finnish exports to Russia. Changes in banking regulation, risks in target countries, slow economic growth and stiffer export competition, accentuating the financing solutions offered to the buyer, help to maintain demand for export credit guarantees and export credits.

CEO Pauli Heikkilä:

“There are many reports showing that financing for credible growth investments is available in Finland. The situation becomes more difficult when financing is sought for continuing unprofitable operations. In such cases, the providers of financing require that the company has adequate plans for restructuring its operations. For start-up enterprises, difficulties arise if they lack capital of their own for the project. Because the economic outlook remains unclear, banks require a higher proportion of self-financing. Companies that can meet this requirement can also acquire debt financing. The most important consideration is to encourage equity investments in Finnish companies.

Significant increases in Finnvera’s financial powers regarding SMEs and export companies were put forward in the Government’s 2013 supplementary budget and in this spring’s discussion on spending limits. If implemented, these measures will further improve Finnvera’s possibilities to complement the availability of financing from the private market. It is also important that Finnish export companies have access to competitive export financing so that they can submit tenders on the same terms as the exporters in competitor countries.”

Additional information:

Pauli Heikkilä, CEO, tel. +358 29 460 2400

Ulla Hagman, Senior Vice President, Finances and IT, tel. +358 29 460 2458