The Finnvera Group’s Interim Report for January–March 2013

Finnvera’s capacity to take risks in SME financing increased

Finnvera will be even more active in providing financing for the working capital and investments of SMEs. Cooperation is conducted with banks and insurance companies whose business is affected by the increased regulation. Additional risk-taking in keeping with the Government Programme is directed so as to meet the needs of companies aiming at growth and internationalisation, as well as the needs of start-up companies. As of the start of the current year, the State will compensate Finnvera for a greater share, or 75 per cent, of any losses that may arise from financing granted to these companies. The compensation remains otherwise unchanged, gradated according to the division into assisted areas. In practice, the increased capacity to take risks means that Finnvera can account for a larger share of financing granted to enterprises striving to enter international markets. At the same time, the principles of self-financing and risk-sharing required in projects of various types have been specified to make them nationally uniform.

Business operations and financial trend

The value of financing offers given by Finnvera for exports during January–March was four per cent less than the year before. The value of the financing offers given to SMEs was one fifth less than during the corresponding period last year. The number of financing applications was bigger than the year before. However, the average size of projects was smaller.

Investment decisions made by Finnvera’s Venture Capital Investments in January–March increased on the previous year. The private investor network, which comprised about 250 business angels at the end of 2012, will be transferred to the private Finnish Business Angels Network (FiBAN) during 2013.

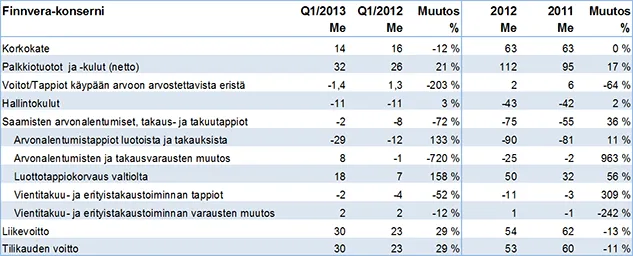

The Finnvera Group’s profit in January–March was EUR 30 million. The profit was nearly one third greater than during the corresponding period last year (23 million).The main factors contributing to the improved performance were the increase in the parent company’s fee and commission income and the decrease in impairment losses on receivables and guarantee losses in SME financing.

Export financing accounted for EUR 21 million (14 million) of the Group’s profit, while domestic credit and guarantee operations accounted for EUR 11 million (9 million). The Group companies and associated companies had an effect of EUR -2 million on the profit (0.3 million).

The Group’s key figures on 31 March 2013

- Capital adequacy 16.0 per cent (15.7)

- Cost/income ratio 28.3 per cent (28.1)

- Equity ratio 20.1 per cent (24.7).

Outlook for the rest of the year

The effects of bank regulation restrict banks’ participation in the financing of enterprises and raise the price paid for financing. These factors, together with the low level of investments, will keep the demand for SME financing at a moderate level.

It is likely that the decline in export demand is reflected in reduced demand for export credit guarantees and export credits. However, Finnvera’s role will be even more important for export financing.

Finnvera's Q1 result was clearly better than in the corresponding period last year. Due to the financial insecurity and the high risks attached to Finnvera's commitments, however, the result for 2013 will probably be similar to the result last year. If materialised, individual risks may weaken the result considerably.

CEO Pauli Heikkilä:

“The sluggish economy and the low level of investments were reflected in the demand for our financing products during the first quarter. The fact that investments remained slight clearly reduced the need for both domestic and export financing.

The number of applications we received from SMEs was five per cent more than during the first quarter of 2012, but their total sum declined by 14 per cent. This indicates that financing was needed largely for working capital and very little for investments. Demand for export credit guarantees and export credits was fairly brisk and only slightly less than the year before. It is typical that demand for export financing varies in step with individual major capital goods transactions.

The Ministry of Employment and the Economy has redefined the division of labour concerning the State’s venture capital investments, and Finnvera will gradually exit from venture capital investments. Direct investments in innovative start-up enterprises through Seed Fund Vera Ltd will continue until 2017.”

Additional information:

Pauli Heikkilä, CEO, tel. +358 29 460 2400

Ulla Hagman, Senior Vice President, Finances and IT, tel. +358 29 460 2458