Management of ESG risks and a long-term monitoring is essential in financing – take a look at Finnvera’s review of 2023

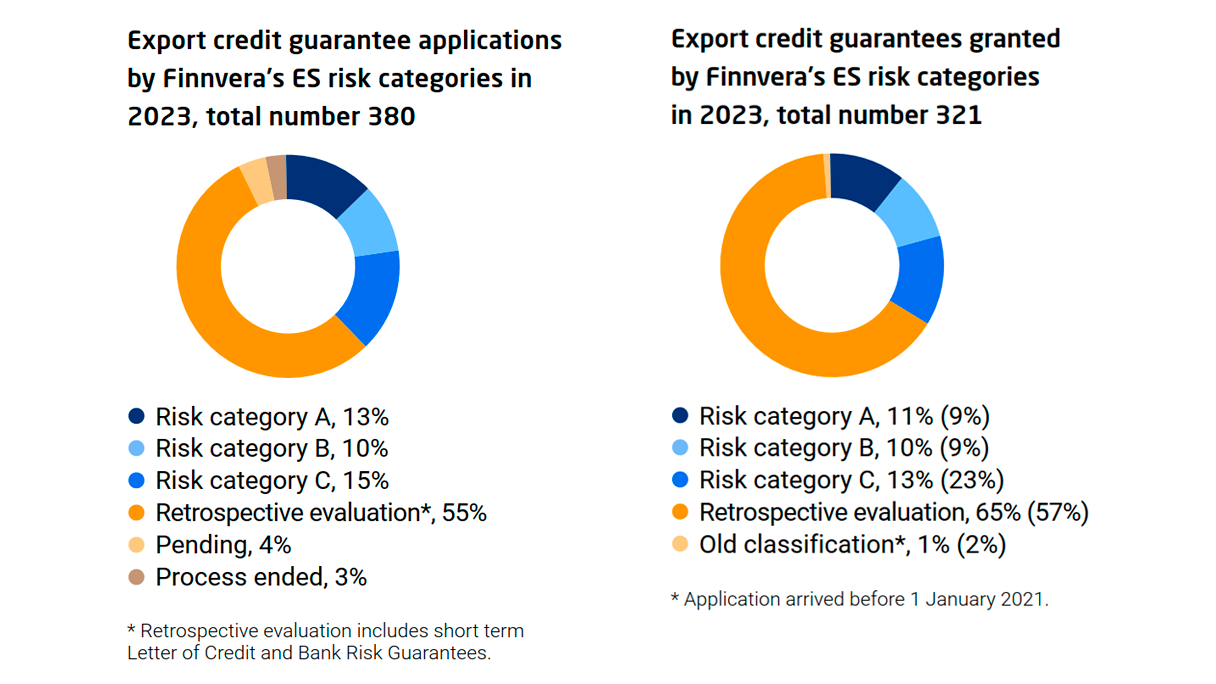

Large high-risk projects for which an extensive ES risk assessment was required accounted for 9 projects and 2% of the export credit guarantee applications Finnvera received in 2023.

Published date

Finnvera screens all export financing applications for environmental and social (ES) risks. The themes of the risk assessment include the reputation of the export product’s end user, human rights and political situation in the country, environmental and social risks inherent in the combination of the country and sector, and environmental factors of the site, including the proximity of nature conservation areas and the status of indigenous peoples. Finnvera continues to monitor the fulfilment of the environmental and social requirements of projects throughout the loan repayment period, which may be between 10 and 15 years in large export projects financed by the company. In domestic financing, Finnvera introduced a new process to obtain ESG reports (environment, social and governance) on companies applying for financing. In addition to our own employees, issues related to the working conditions and terms of employment of workers in projects we finance play an important role in Finnvera’s social responsibility. This is how Finnvera carried through ESG monitoring in 2023.

Indicators have been defined for different thematic areas, on the basis of which the application is assigned a risk category (A/B/C) as defined by Finnvera. Finnvera received a total of 380 (371) applications for export credit guarantees in 2023. Large high-risk projects for which an extensive ES risk assessment was required accounted for 9 projects and 2% of the export credit guarantee applications received in 2023. The prerequisites for going ahead with the project are discussed with the parties to an export transaction. The aim is to be proactive and provide guidance, enabling the transaction to meet the requirements.

No financing applications were rejected by Finnvera due to environmental and social risks in 2023.

Monitoring of financed projects as a development area

A project monitoring plan is also agreed upon as part of the financing agreement. Finnvera developed the monitoring of the projects financed by the company in 2023. The aim was to create a systematic reporting model to monitor the big picture of Finnvera's projects and to allocate resources to monitoring.

The monitoring currently covers 27 projects, of which in 17 an external consultant is involved. These projects are located in ten different countries. They mainly are large projects in the pulp and paper and energy and mining sectors that have been identified as having significant ES risks in the project assessment phase and classified in ES risk category A.

Finnvera continues to monitor the fulfilment of the environmental and social requirements of projects throughout the loan repayment period, which may be between 10 and 15 years in large export projects financed by the company. The fulfilment of the requirements is checked by an independent consultant required by Finnvera as specified in the credit agreement. By means of timely intervention in any shortcomings, Finnvera strives to ensure that the project progresses and is implemented responsibly in keeping with the agreed international standards and Finnvera's requirements.

Attention to the project’s overall situation on site visits

In major export projects, an independent consultant visits the site to be financed in the assessment phase and prepares an Environmental and Social Due Diligence (ESDD) report. The report assesses if the project meets the requirements of the World Bank Group’s Environmental, Health, and Safety Guidelines and the IFC’s Performance Standards for Environmental and Social Sustainability as well as other possible preconditions set by Finnvera. In addition, it presents the measures that must be taken to meet these requirements.

In 2023, Finnvera's expert visited two project sites.

Social responsibility in the financed projects

The financed projects are often carried out in countries with shortcomings in their human rights legislation and the realisation of human rights. This is why assessing the social impacts and risks of the projects is an important part of financing decisions. Finnvera is committed to respecting human rights in accordance with the UN Guiding Principles on Business and Human Rights, the International Labour Organization Working Life Principles and the OECD Guidelines on Multinational Enterprises. When assessing the human rights impacts of export projects, particular attention is paid to vulnerable groups of people, and projects are assessed from the perspective of both labour rights and impacts on local residents.

Human rights play an important role in risk assessments of projects to be financed

The UN Guiding Principles on Business and Human Rights (UNGP), IFC’s Performance Standards on Environmental and Social Sustainability, and any other requirements imposed by Finnvera are taken into account when assessing financing projects. In large-scale industrial export projects financed by Finnvera, not only workers’ conditions but issues related to land rights and the status of indigenous peoples are often assessed. These impacts are examined on site visits by talking to local people and stakeholders, and Finnvera also engages in dialogue with NGOs on taking human rights perspectives into account.

In this respect, there are differences between sectors. In the telecommunications sector, the focus in human rights issues in 2023 was on assessing the project's operating environment and the operator’s operating principles. Finnvera has organised different types of training to raise awareness of human rights issues among its employees.

ESG report complements information on a company’s risks

Finnvera introduced Suomen Asiakastieto’s responsibility reporting service in domestic financing to obtain ESG reports (environment, social and governance) on companies applying for financing. In addition to extensive basic information on the company, the report also contains information on climate emissions, energy consumption and environmental taxes in the sector as well as any quality, occupational safety and environmental certificates issued to the company.

Once the SME financing application is received in Finnvera's system, a brief ESG report on the company is retrieved automatically. If the report contains any sections highlighted in red, which means that some of the information requires attention, the system retrieves a more extensive report for the account manager to review. When making financing decisions, Finnvera's account manager must take a stand on the reasons for the highlighted areas in the ESG report and the measures taken regarding them. In the future, Finnvera will use a traffic light system to monitor the development of corporate responsibility among the clients.

Finnvera does not accept corruption in any form

The company applies anti-corruption principles in all operations and also expects its clients and business partners to take anti-corruption measures. Finnvera is additionally committed to complying with the OECD's Anti-Bribery Recommendation for export financing, in keeping with which the company strives to identify bribery risks in advance and minimise them in projects financed by it.

Finnvera's role as a public provider of financing and in channelling EU funds also necessitates comprehensive measures to combat tax evasion. In order to be eligible for financing, client enterprises must comply with the applicable regulations and good practices in tax matters. The aim is to manage risks by identifying any links to tax havens that the owners of companies to be financed may have and by obtaining reports on tax obligations.

Finnvera also complies with practices that prevent money laundering and the financing of terrorism in its financing operations by applying the client identification and KYC (Know Your Customer) obligations recommended by the Financial Supervisory Authority and internal procedures. As an essential part of processing financing applications, Finnvera investigates the identifying data of the applicant enterprise, its ownership structure, the nature of its business and the object of financing. Applicants are also required to provide information on who the actual beneficiaries are and whether a beneficiary in the client enterprise is a politically exposed person. The background screening additionally extends to the export company's buyer client and, if necessary, to other parties in the project to be financed in most export financing products.

Read more:

Finnvera's Annual Review and Sustainability Report 2023 (PDF)

Read more about the process for managing ES risks on Finnvera’s website.